Editor's Notes: "The FDIC: Protecting Your Deposits And Ensuring The Strength Of The Banking System" have been published on March 2023. We all know that our economy heavily depends on the banking system in a country. So, it is more important that the banking systems of a country should be stable. The Federal Deposit Insurance Corporation does the same job for the banking customers and depositors by insuring the deposits in FDIC-member banks, it protects their deposits up to $250,000. FDIC insurance also gives depositors confidence in the banking system, which encourages them to save and invest their money in banks.

Our team has done a lot of research, digging deep into all the available information about the topic and put together information here. So that target audience can make the right decision.

FAQ

This section presents a list of frequently asked questions and their corresponding answers to provide clarification on various aspects related to The FDIC: Protecting Your Deposits And Ensuring The Strength Of The Banking System

/FDIC_Seal_by_Matthew_Bisanz-b92facd3f0304834b33c305f7f9b2007.jpeg)

What Are the FDIC Rules for CDs? - Source www.investopedia.com

Question 1: What is the role of the FDIC?

Answer: The FDIC is an independent agency of the United States government that protects deposits up to $250,000 at FDIC-member banks. It also provides financial assistance to failing banks and helps to ensure the stability of the banking system.

Summary: The information provided in this FAQ section serves to address common queries and misconceptions regarding the FDIC's mission and functions. By understanding the FDIC's role in safeguarding depositors' funds and maintaining the health of the banking system, individuals can make informed decisions about their finances.

For further information and resources, please visit the official FDIC website.

Tips

The Federal Deposit Insurance Corporation (FDIC) is an independent agency created by the U.S. Congress to maintain stability and public confidence in the nation's financial system. Here are some tips to help you protect your deposits and ensure the strength of the banking system:

Tip 1: Choose a bank that is FDIC-insured. The FDIC insures deposits up to $250,000 per depositor, per insured bank, for each account ownership category.

Tip 2: Spread your deposits across multiple banks if they exceed the FDIC insurance limit. This will ensure that your funds are protected even if one bank fails.

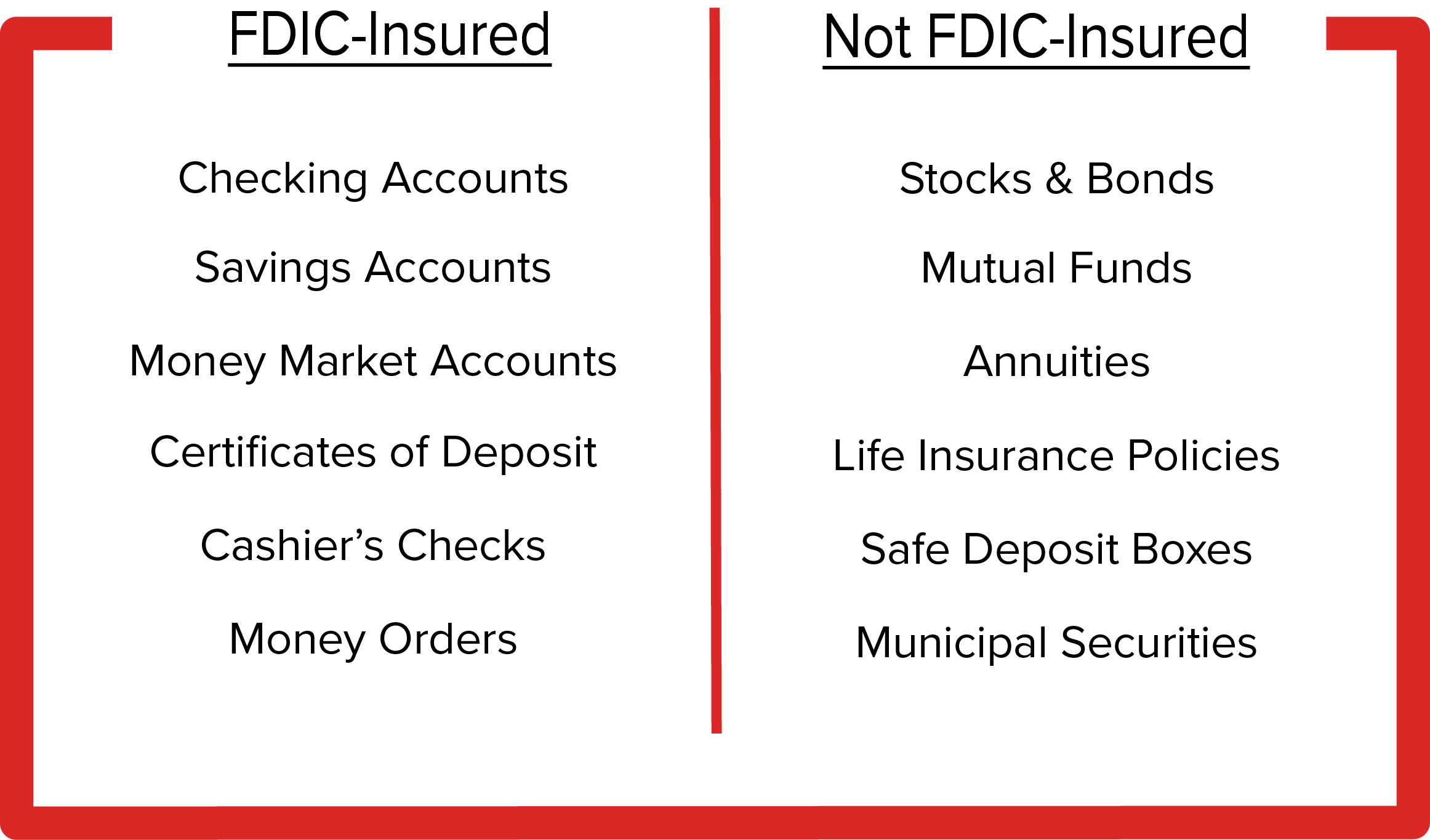

Tip 3: Keep your deposit accounts separate from your investment accounts. This will help to protect your deposits if your investments lose value.

Tip 4: Monitor your bank statements regularly for any unauthorized withdrawals or other suspicious activity. If you notice any discrepancies, report them to your bank immediately.

Tip 5: Be aware of the signs of bank failure. These signs can include a decline in the bank's financial performance, a decrease in the number of customers, or a change in the bank's ownership.

Tip 6: If you are concerned about the safety of your deposits, you can contact the FDIC for more information. The FDIC provides a variety of resources to help consumers protect their deposits and ensure the strength of the banking system.

By following these tips, you can help to protect your deposits and ensure the strength of the banking system.

The FDIC: Protecting Your Deposits And Ensuring The Strength Of The Banking System

The Federal Deposit Insurance Corporation (FDIC) is an essential institution within the US financial landscape. Its primary mission is to protect depositors' funds in the event of a bank failure, thereby maintaining public confidence in the banking system. This article explores six key aspects of the FDIC's role in safeguarding deposits and fostering banking system stability.

These aspects work in tandem to create a robust banking system. Deposit insurance provides depositors peace of mind, while bank supervision and resolution mechanisms mitigate risks and promote financial stability. Consumer education empowers individuals to make informed financial decisions, strengthening the financial system. By playing a pivotal role in safeguarding deposits and ensuring banking system strength, the FDIC fosters public trust and lays the foundation for a thriving economy.

Safeguarding Your Business Finances: FDIC Insurance and Effective - Source www.farmbureau.bank

The FDIC: Protecting Your Deposits And Ensuring The Strength Of The Banking System

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that protects depositors against the loss of their insured deposits in the event of a bank failure. The FDIC also plays a vital role in ensuring the strength and stability of the banking system, as it has the authority to regulate and supervise banks, as well as to provide financial assistance to banks that are experiencing financial difficulties.

The FDIC was created in 1933, in the wake of the Great Depression, which saw a wave of bank failures that wiped out the savings of millions of Americans. The FDIC was charged with the mission of preventing such a disaster from happening again, and it has been successful in doing so. Since its creation, the FDIC has protected the deposits of over 99% of depositors, and no depositor has ever lost a penny of insured funds. The FDIC has also helped to stabilize the banking system by providing financial assistance to banks that are experiencing financial difficulties, and it has played a key role in preventing bank failures.

The FDIC's deposit insurance system is a key component of the U.S. financial system. It provides depositors with peace of mind, knowing that their money is safe, even if their bank fails. This peace of mind encourages people to save money in banks, which helps to fuel economic growth. The FDIC's bank regulation and supervision system also helps to ensure the safety and soundness of the banking system, which is essential for a healthy economy.

Conclusion

The FDIC is a vital part of the U.S. financial system. It protects depositors' money, helps to ensure the strength and stability of the banking system, and encourages economic growth. The FDIC's deposit insurance system is a key component of the U.S. financial safety net, and it has been successful in preventing bank failures and protecting depositors' money.

The FDIC will continue to play a vital role in the U.S. financial system in the years to come. As the banking system evolves, the FDIC will need to adapt its regulations and supervision to ensure that the system remains safe and sound. The FDIC will also need to continue to work with other government agencies to ensure that the financial system is resilient to future crises.