Discover valuable insights into "TD Bank Shares: Price Movements And Investment Insights" while you ascertain key decision-making factors

Editor's Notes: "TD Bank Shares: Price Movements And Investment Insights" have been published today. Stay informed about the latest trends and expert analysis. This article is crucial for investors seeking to make informed decisions about TD Bank shares.

Through extensive analysis and comprehensive information gathering, we have crafted this TD Bank Shares: Price Movements And Investment Insights guide to equip you with the knowledge necessary for sound investment decisions.

Key Takeaways:

| Aspect | Key Difference |

| Price Movements | Highlights the historical and current price performance of TD Bank shares, including factors influencing price fluctuations. |

| Investment Insights | Provides expert analysis and insights into the bank's financial performance, industry trends, and potential investment opportunities. |

Main Article Topics:

FAQ

delve deeper into the nuances affecting TD Bank shares, its price movements, and astute investment insights.

Question 1: What key factors influence TD Bank share price movements?

TD Bank share prices are swayed by a medley of macroeconomic factors, including interest rate fluctuations, economic growth prospects, and industry-specific trends. Moreover, the bank's financial performance, regulatory changes, and investor sentiment also exert a significant impact.

Question 2: How has TD Bank performed recently, and what are its growth prospects?

TD Bank has consistently delivered robust financial performance, driven by organic growth and strategic acquisitions. Its diversified business model, strong capital position, and expanding customer base position it well for continued growth.

Best TD Credit Cards Canada: One For Every Need | Yore Oyster - Source www.yoreoyster.com

Question 3: What investment strategies should one consider for TD Bank shares?

Investment strategies for TD Bank shares vary based on individual risk tolerance and investment objectives. Long-term investors may opt for a buy-and-hold approach, while those seeking short-term gains may consider technical analysis or value investing techniques.

Question 4: Are there any risks associated with investing in TD Bank shares?

As with any investment, investing in TD Bank shares carries certain risks. These include economic downturns, regulatory changes, increased competition, and geopolitical uncertainties.

Question 5: What are the key factors to consider before making an investment decision?

Before investing in TD Bank shares, it is crucial to assess factors such as the bank's financial health, industry outlook, management effectiveness, and overall risk tolerance.

Question 6: Where can I find more information and insights about TD Bank?

For comprehensive analysis and up-to-date information on TD Bank shares, refer to reputable financial news sources, company filings, and industry reports. TD Bank Shares: Price Movements And Investment Insights provides valuable insights into the bank's performance, market dynamics, and investment strategies.

Remember to thoroughly research and consult with a financial advisor before making any investment decisions.

Stay informed and make prudent investment choices.

Tips

The TD Bank Shares: Price Movements And Investment Insights article provides valuable information for investors interested in TD Bank. To enhance your understanding, consider the following tips while reading the article:

Tip 1: Track Long-Term Trends:

TD Bank Statement Template: Create Authentic Statements With - Etsy - Source www.etsy.com

Examine the article's historical data on TD Bank's share price movements. Long-term trends can reveal overall market sentiment and potential growth indicators.

Tip 2: Monitor Economic Factors: Pay attention to the article's analysis of economic conditions. Economic events, such as interest rate changes and GDP growth, can significantly impact the performance of financial institutions.

Tip 3: Analyze Industry Trends: Review the article's discussion of the banking industry as a whole. Understanding industry trends can provide context for TD Bank's performance and competitive position.

Tip 4: Examine Financial Performance: Carefully assess the article's presentation of TD Bank's financial metrics. Factors such as profitability,资产 and revenue growth, can indicate the bank's financial health and stability.

Tip 5: Consider Risk Tolerance: Be mindful of your own risk tolerance when making investment decisions. The article may provide insights into potential risks associated with investing in TD Bank, which you should weigh against your financial goals and circumstances.

Tip 6: Seek Professional Advice: If needed, consider consulting with a financial advisor. A professional can provide tailored guidance based on your specific financial situation and risk profile.

In conclusion, by following these tips, you can maximize the effectiveness of your reading and gain a comprehensive understanding of the information provided in the TD Bank Shares: Price Movements And Investment Insights article.

TD Bank Shares: Price Movements And Investment Insights

Understanding the dynamics of TD Bank shares is crucial for investors seeking informed decision-making. Key aspects to consider include price movements, market trends, company performance, and economic factors. This article will explore these aspects, providing valuable insights for investment strategies.

-

Various Management Jobs - TD Bank Careers - Jobs in Germany - Source worldwide.govhelp.inPrice Performance:

Analyzing historical and real-time stock prices to identify trends and patterns. - Market Dynamics: Monitoring interest rates, inflation, and economic indicators to assess market fluctuations.

- Earnings Reports: Reviewing financial statements to evaluate the company's financial health, growth, and future profitability.

- Dividend History: Studying past dividend payments and dividend yield to determine the company's commitment to shareholder returns.

- Industry Analysis: Understanding the competitive landscape and industry trends that can influence TD Bank's performance.

- Expert Perspectives: Consulting with financial analysts and industry experts to gain insights from different perspectives.

By considering these key aspects, investors can develop a comprehensive understanding of TD Bank's shares, assess potential risks and opportunities, and make informed investment decisions. Monitoring price movements in conjunction with market dynamics and company performance provides a holistic view of the stock's trajectory. Additionally, understanding the company's dividend history and industry outlook helps investors gauge long-term growth prospects. Seeking expert perspectives and utilizing research tools offer valuable insights that can enhance investment strategies.

TD Bank Shares: Price Movements And Investment Insights

The price movements of TD Bank shares are influenced by numerous factors, including economic conditions, interest rates, competition, and investor sentiment. Understanding these factors is crucial for investors seeking to make informed investment decisions.

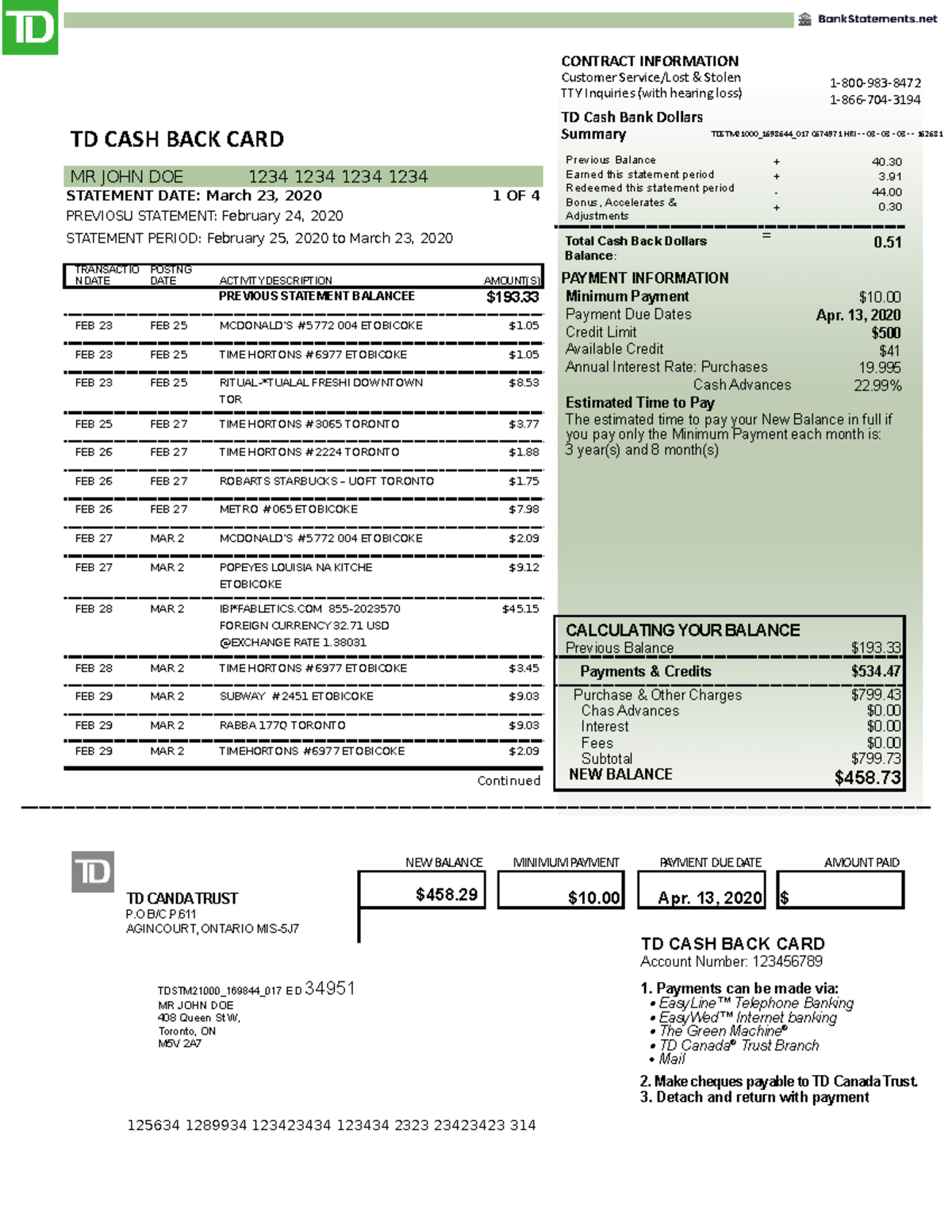

TD Bank Statement Bank Statements - CONTRACT INFORMATION Customer - Source www.studocu.com

Economic conditions, such as GDP growth and unemployment rates, impact the demand for TD Bank's products and services, affecting its revenue and profitability. Interest rates influence the bank's net interest margin, which is a key driver of its profitability. Competition from other banks and financial institutions also affects TD Bank's market share and pricing power. Lastly, investor sentiment, driven by news and market conditions, can drive short-term price fluctuations.

By analyzing these factors and their potential impact on TD Bank's business, investors can make informed investment decisions. Monitoring economic indicators, tracking interest rate movements, assessing competitive dynamics, and gauging investor sentiment are essential for successful investing.

The table below provides a structured overview of the key factors influencing TD Bank's share price and their potential impact: