HZMO Pension Payment: A Comprehensive Guide For Beneficiaries

Editor's Note: "HZMO Pension Payment: A Comprehensive Guide For Beneficiaries" has been updated recently to address new changes in rules and regulations.

Receiving pension payments from HZMO is a significant event in the lives of beneficiaries. Understanding the process and requirements can help ensure timely and accurate payments. This guide provides a comprehensive overview of HZMO pension payments, covering eligibility, payment schedules, and essential documentation required.

Key Differences

| Eligibility | Payment Schedules | Documentation |

|---|---|---|

| Based on age, years of service, and contributions | Monthly or quarterly payments; amount varies depending on factors | Proof of identity, income, and employment history |

Understanding Eligibility

To be eligible for HZMO pension payments, beneficiaries must meet specific criteria, including:

- Reaching retirement age (typically 65 years)

- Having worked for a certain number of years (usually at least 10 years)

- Having made sufficient contributions to the pension scheme

Payment Schedules

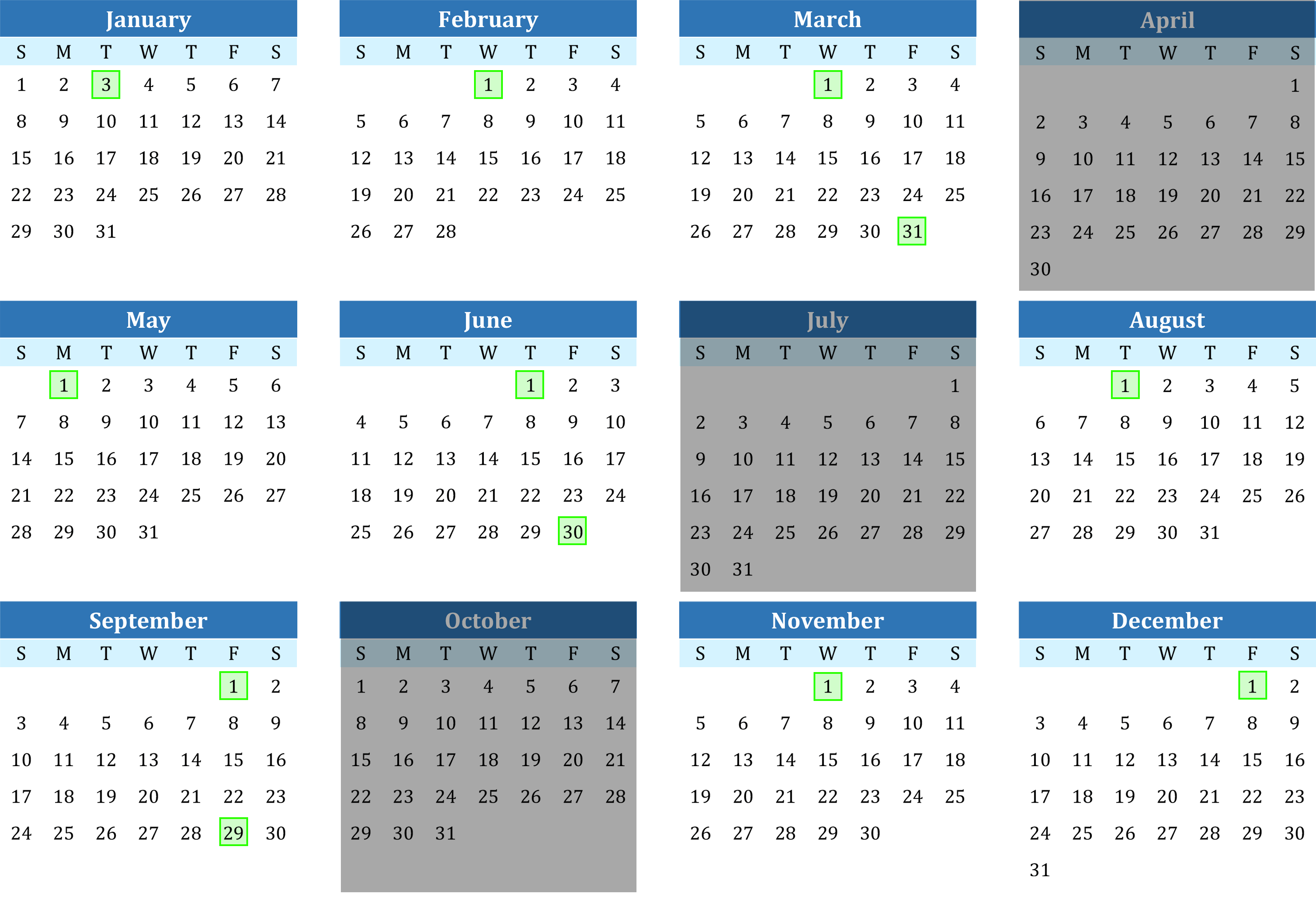

HZMO pension payments are typically made on a monthly or quarterly basis. The amount of the payment is determined by factors such as the beneficiary's age, years of service, and contributions made. Payments are typically adjusted annually based on inflation and other economic factors.

Essential Documentation

When applying for HZMO pension payments, beneficiaries must provide the following documentation:

- Proof of identity (e.g., passport, driver's license)

- Proof of income (e.g., payslips, tax returns)

- Proof of employment history (e.g., employment records, contribution statements)

Conclusion

HZMO pension payments play a crucial role in providing financial security to beneficiaries during their retirement years. Understanding the eligibility criteria, payment schedules, and essential documentation required is vital for a smooth and successful application process. By following the guidelines outlined in this comprehensive guide, beneficiaries can navigate the process efficiently and ensure timely receipt of their pension payments.

FAQ

This section addresses frequently asked questions regarding the HZMO Pension Payment to provide beneficiaries with comprehensive information. HZMO Pension Payment: A Comprehensive Guide For Beneficiaries

Centrelink Age Pension: A Comprehensive Guide - United Global Capital - Source ugc.net.au

Question 1: What is the eligibility criteria for receiving HZMO Pension Payment?

To be eligible, individuals must meet specific requirements outlined by the HZMO Pension Plan. These criteria may include factors such as age, years of service, and contributions made to the plan.

Question 2: How is the HZMO Pension Payment calculated?

The HZMO Pension Payment is typically calculated based on a formula that considers factors such as the beneficiary's years of service, average salary, and applicable pension plan provisions.

Question 3: When will I start receiving my HZMO Pension Payment?

The commencement date for HZMO Pension Payments varies depending on the specific pension plan and the beneficiary's individual circumstances. It is advisable to contact the HZMO Pension Plan administrator for accurate information.

Question 4: Can I choose how my HZMO Pension Payment is paid?

In most cases, beneficiaries have the option to choose from various payment methods, such as monthly installments, lump sum distributions, or a combination of both. The available options may vary depending on the pension plan.

Question 5: What happens to my HZMO Pension Payment if I pass away?

Upon the beneficiary's passing, the HZMO Pension Payment may be subject to specific provisions outlined in the pension plan. These provisions may include survivor benefits or the distribution of remaining funds to designated beneficiaries.

Question 6: Where can I get more information about the HZMO Pension Payment?

Beneficiaries seeking additional information should contact the HZMO Pension Plan administrator. The administrator can provide detailed guidance and answer any specific questions related to the pension payment and related matters.

Understanding the intricacies of the HZMO Pension Payment is crucial for beneficiaries to make informed decisions and plan for their financial future. By addressing these common concerns and providing comprehensive information, this FAQ section aims to empower beneficiaries with the knowledge they need.

For further insights and a comprehensive guide on HZMO Pension Payment, refer to HZMO Pension Payment: A Comprehensive Guide For Beneficiaries.

Tips for HZMO Pension Payment Beneficiaries

Understanding the HZMO pension payment process is crucial for beneficiaries. Here are some comprehensive tips to ensure a smooth and timely payment:

Nys Pension Calendar 2024 With Holidays - Klara Michell - Source tessyvemmeline.pages.dev

Tip 1: Eligibility Verification

Confirm eligibility by verifying the deceased's contributions and meeting the required years of service. Ensure you have the necessary documentation, such as the deceased's employment records and ID.

Tip 2: Application Process

File the appropriate application form promptly to initiate the payment process. Gather all required supporting documents, including the death certificate and proof of beneficiary status.

Tip 3: Payment Schedule

Understand the HZMO pension payment schedule. Payments are typically made monthly or annually. Check with the HZMO pension department to confirm the specific dates.

Tip 4: Tax Implications

Be aware of any tax implications associated with pension payments. Pension income may be subject to taxation. Consult with a tax advisor for specific guidance.

Tip 5: Payment Options

Explore the available payment options, such as direct deposit or check. Choose the option that aligns with your preference and ensures prompt and secure delivery of payments.

Summary

By following these tips, beneficiaries can navigate the HZMO pension payment process effectively. Verifying eligibility, submitting timely applications, understanding payment schedules, factoring in tax implications, and exploring payment options contribute to a seamless and successful claim.

HZMO Pension Payment: A Comprehensive Guide For Beneficiaries

HZMO pension payment is a crucial financial benefit for eligible individuals. Understanding the key aspects of this benefit is essential for beneficiaries to ensure timely and accurate payments. This guide will delve into six key aspects, providing essential information to assist beneficiaries in navigating the process successfully.

- Eligibility Requirements: Determining who qualifies for HZMO pension benefits.

- Payment Schedule: Understanding the frequency and timing of pension payments.

- Payment Amount: Factors influencing the calculation of pension payments.

- Payment Methods: Options available for receiving pension payments.

- Tax Implications: Taxation considerations related to pension payments.

- Beneficiary Rights: Legal rights and protections available to beneficiaries.

These aspects are interconnected, forming a comprehensive framework for HZMO pension payments. For example, eligibility requirements define who can receive benefits, while the payment schedule determines when payments are made. Understanding the payment amount ensures accurate calculations, and choosing the appropriate payment method facilitates convenient access to funds. Tax implications impact the net amount received, and beneficiary rights safeguard the interests of those entitled to benefits. By grasping these key aspects, beneficiaries can effectively manage their HZMO pension payments, ensuring financial security and peace of mind.

Understanding the 2025 Pension Payment Calendar: A Comprehensive Guide - Source gadingku88.com

HZMO Pension Payment: A Comprehensive Guide For Beneficiaries

As an individual entitled to receive pension payments from the Health Professions Council of Zambia (HPCZ), it is crucial to possess a thorough understanding of the process involved. "HZMO Pension Payment: A Comprehensive Guide For Beneficiaries" serves as an invaluable resource for navigating the intricacies of pension payments, ensuring that beneficiaries are well-informed about their rights and responsibilities. The guide covers a wide range of topics essential for beneficiaries, including eligibility criteria, payment procedures, and dispute resolution mechanisms.

.png)

Personal Pension for Self-Employed: A Comprehensive Guide - Source www.finanz2go.com

Comprehending the information provided in this guide is paramount for several reasons. Firstly, it empowers beneficiaries with the knowledge to make informed decisions regarding their pension payments. By understanding the eligibility requirements, payment schedules, and tax implications, beneficiaries can plan their financial future with greater confidence. Secondly, it facilitates seamless communication with the HPCZ. Beneficiaries who are well-versed in the pension payment process can effectively communicate their inquiries and concerns, ensuring timely and accurate responses. Lastly, it promotes transparency and accountability. The guide serves as a reference point for beneficiaries, allowing them to hold the HPCZ accountable for adhering to established regulations and procedures.

Real-life examples further illustrate the importance of understanding pension payments. Consider a scenario where a beneficiary is unaware of the age requirement for receiving pension payments. This lack of knowledge could lead to delayed payments or even forfeiture of benefits. Alternatively, a beneficiary who is familiar with the payment procedures can proactively follow up on their payments, preventing unnecessary delays.

In conclusion, "HZMO Pension Payment: A Comprehensive Guide For Beneficiaries" is an indispensable resource that empowers beneficiaries with the knowledge and understanding necessary to navigate the pension payment process effectively. By embracing the information provided in the guide, beneficiaries can ensure that their pension payments are processed accurately, efficiently, and in accordance with established regulations.

| Key Insight | Practical Significance |

|---|---|

| Understanding eligibility criteria | Ensures timely receipt of pension payments |

| Familiarity with payment procedures | Facilitates proactive follow-up and prevents delays |

| Awareness of dispute resolution mechanisms | Empowers beneficiaries to address concerns effectively |